The procedures for filing taxes and submitting documents have changed dramatically in today’s digital landscape. Traditional paper-based submissions have been supplanted by digital signatures, which have had a revolutionary impact on signing and completing tax forms. We will delve into the world of digital signatures for tax forms, with a particular focus on income tax e-filing. We’ll look into the complexities of digital signature certificates, particularly those offered by recognized providers such as TRUESigner ONE, highlight their multiple benefits, and give readers complete guidance on effectively integrating them into the tax filing process. With eSignatures, taxpayers may traverse the complexity of tax compliance with increased efficiency and convenience, representing a significant step forward in digitizing financial activities.

What is a Digital Signature Certificate?

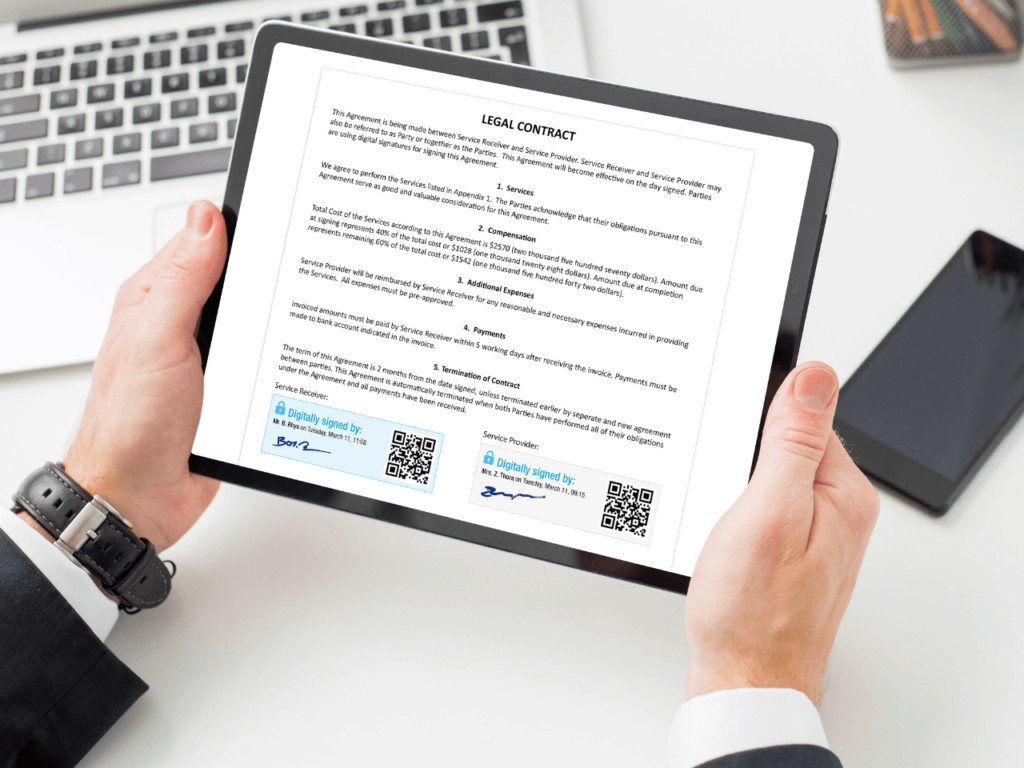

A Digital Signature Certificate (DSC) is a secure digital key issued by a certifying authority to confirm the holder’s identity while signing electronic documents. It verifies the validity, integrity, and non-repudiation of the signed document. In tax filing, a DSC is the electronic equivalent of a handwritten signature on paper forms, allowing the e-filing of income tax returns online, which is a secure and legally binding process.

Benefits Of Using Digital Signature For Income Tax e-filing:

- Enhanced Security: Digital signatures are more secure than traditional paper-based signatures, lowering the risk of fraud and unauthorized access to sensitive tax information.

- Time and Cost Efficiency: Filing income tax returns online with a digital signature eliminates the need for physical paperwork, saving taxpayers and tax authorities time and resources.

- Legal Validity: Digital signatures adhere to the Electronic Signature Program’s requirements, guaranteeing that electronically signed tax filings are legally valid.

- Convenience: Taxpayers can quickly sign and submit tax forms from anywhere with an internet connection, eliminating the need to print, sign, and mail physical paperwork.

Steps to Register the Digital Signature When E-Filing the ITR:

1. Acquire a Digital Signature Certificate (DSC) from a licensed certifying authority:

First, secure a Digital Signature Certificate (DSC) from a government-authorized certifying authority. These agencies guarantee the legitimacy and security of your Digital Signature. You can apply for a DSC online or in person at their office, where you’ll need to produce identification and fill out the relevant paperwork. Once issued, the DSC is your digital identity when signing electronic documents.

2. Register the DSC on the Income Tax Department’s e-filing portal:

After acquiring the DSC, you must register it on the Income Tax Department’s official e-filing portal. Log in to your account on the portal using your credentials. Then, navigate to the section for eSignature registration. Follow the prompts to upload your DSC file and enter the required details, such as the certificate serial number and validity period. Ensure all information is accurate and complete before proceeding.

3. Complete the authentication process by linking the DSC with the taxpayer’s PAN (Permanent Account Number):

To ensure the legitimacy of your digital signature, it needs to be linked with your PAN (Permanent Account Number). This process involves verifying your identity by cross-referencing the information provided during DSC registration with the PAN database. Follow the instructions on the e-filing portal to initiate this authentication process. You may need to enter additional details or answer security questions for verification purposes.

4. Upon successful registration, the DSC can be used to sign and submit income tax returns electronically:

Once the authentication process is complete and your DSC has been successfully registered and linked to your PAN, you can begin using it to sign and submit your income tax forms electronically. When you complete your tax return through the e-filing site, you will be prompted to digitally sign the document with your registered DSC. After you’ve signed digitally, double-check the information to ensure it’s correct before submitting the return electronically. Your DSC verifies the validity and integrity of your submission, making the entire procedure secure and legally binding.

Steps to Perform Online Upload of Income Tax Return with Digital Signature:

1. Log in to the Income Tax Department’s e-filing portal using valid credentials:

Enter your user ID and password to access the Income Tax Department’s official e-filing portal. Ensure your credentials are valid and up-to-date to log in to your account successfully.

2. Select the appropriate income tax return form and fill in the required details:

Once logged in, navigate to the section for filing income tax returns. Choose the relevant tax return form based on your income and financial status for the assessment year. Carefully fill in all the required details in the form, including personal information, income sources, deductions, and tax liabilities. Ensure accuracy and completeness to avoid discrepancies.

3. Choose the option to sign the return using the registered DSC digitally:

After filling in the necessary details, proceed to the signature section of the tax return form. Select the option to digitally sign the return using the registered Digital Signature Certificate (DSC). This step is crucial as it ensures the authenticity and integrity of your tax return submission.

4. Attach any supporting documents as necessary:

If required, attach supporting documents such as Form 16, investment proofs, bank statements, and other relevant documents to substantiate the information provided in the tax return form. Ensure that all attachments are in the specified format and comply with the guidelines provided by the Income Tax Department.

5. Verify the information provided and submit the return electronically:

Before final submission, carefully review all the information in the tax return form and the attached documents. Verify the accuracy of income figures, deductions claimed, and tax liabilities. Once satisfied with the information provided, submit the tax return electronically. Upon successful submission, you will receive an acknowledgement or receipt confirming the submission of your tax return. Keep this acknowledgement for future reference and record-keeping purposes.

Tax Payers Who Should E-File through Digital Signature:

E-filing with a digital signature is recommended for:

- Individuals with business income require an audit under the Income Tax Act.

- Companies and firms are required to furnish tax audit reports.

- Taxpayers seeking a secure and efficient method for filing income tax returns online.

Summing up

Finally, using digital signatures on tax forms accelerates the process of submitting income taxes electronically, providing benefits such as increased security, time and cost efficiency, and legal validity. Taxpayers can submit taxes effortlessly while remaining compliant with regulatory standards by acquiring a Digital Signature Certificate from a licensed certifying authority and following the necessary registration and online submission steps. Switch to Digital Signatures for a more efficient tax filing experience.