Blog Summary: Tired of chasing signatures and drowning in paperwork during tax season? It’s time for a smarter, faster way to manage financial documentation. This blog dives into how electronic signature software is reshaping the accounting and taxation landscape, bringing speed, security, and compliance to the forefront. Whether you’re a solo practitioner or part of a large CA firm, you’ll discover how the right e-signature platform can streamline workflows, reduce errors, and elevate your client experience. Curious about which platform stands out in India for accountants and tax pros? We’ve got the answer. Step into the future of paperless finance—it’s simpler than you think.

In today’s fast-paced financial ecosystem, traditional methods of signing, storing, and sharing tax and financial documents are no longer sustainable. Accountants and tax professionals are handling sensitive client data, facing strict deadlines, and managing extensive paperwork—all of which demand faster, safer, and legally valid alternatives to wet ink signatures. This is where Electronic Signature Software for Accountants and Taxation becomes a game-changer. Among the most reliable solutions in this space is TRUESigner ONE, India’s trusted digital signature platform, simplifying workflows for finance professionals.

The Role of Electronic Signatures in Finance & Taxation

Electronic signatures in accounting have transformed how financial statements, tax returns, audit reports, and other crucial documents are handled. The digital shift supports regulatory compliance, client convenience, and operational efficiency—all while safeguarding document integrity and authenticity. By enabling professionals to authenticate and approve documents remotely, electronic signature software in India like TRUESigner ONE is helping accountants and tax professionals stay agile and secure.

Why Accountants Need Electronic Signature Software

Accountants and tax advisors deal with hundreds of documents daily—from audit confirmations and financial reports to GST filings and digitally signed invoices. The manual collection of signatures is not only time-consuming but also risky when dealing with tight deadlines and strict data confidentiality laws.

Electronic Signature Software for Accountants and Taxation streamlines this entire workflow, enabling professionals to send, sign, and store documents securely within minutes. It minimizes delays, eliminates physical storage, and supports real-time collaboration with clients.

Key Features to Have in Electronic Signature Software

When choosing electronic signature solutions for financial services, firms should look for features that ensure security, compliance, and ease of integration. Here are some non-negotiables:

- Legally compliant signatures (as per IT Act, 2000 and GSTN requirements)

- Time-stamping and audit trail for authenticity

- Cloud-based document storage and retrieval

- Integration with popular accounting tools (like Tally, Zoho Books)

- Role-based access control and encryption

- Mobile compatibility for clients on the go

TRUESigner ONE ticks all these boxes and more, providing the best electronic signature software for accountants and taxation across India.

Benefits of e-Signature for Accounting Firms

- Faster Turnaround Times

Tax filing and audit seasons are notoriously hectic. Electronic Signature for Accountants and Tax Professionals drastically cuts the time spent chasing signatures. - Reduced Operational Costs

Say goodbye to courier charges, printer ink, and storage cabinets. Digital workflows reduce overheads. - Enhanced Data Security

Sensitive information remains encrypted, traceable, and access-controlled. - Client Convenience

Clients can approve financial statements or sign compliance forms from any device, at any location. - Eco-friendly and Scalable

Digital signatures align with sustainability goals and scale easily with your client base.

Common Use Cases

- Signing digitally signed invoices for GST compliance

- Approving balance sheets and audit reports

- Filing e-returns with digital verification

- Internal approvals within CA firms

- Partner onboarding, NDAs, and legal documentation

- Sending salary certificates or investment proofs to clients

The versatility of electronic signatures in accounting makes it an indispensable tool across daily operations.

Compliance and Legal Validity

In India, electronic signatures are legally valid under the Information Technology Act, 2000. When used in accordance with prescribed guidelines, these digital signatures are admissible in courts and regulatory frameworks.

TRUESigner ONE is designed to comply with:

- MCA (Ministry of Corporate Affairs)

- GSTN (Goods and Services Tax Network)

- IT Department (for income tax e-filing)

- SEBI and RBI norms

This ensures that documents signed through TRUESigner ONE hold full legal and evidential validity.

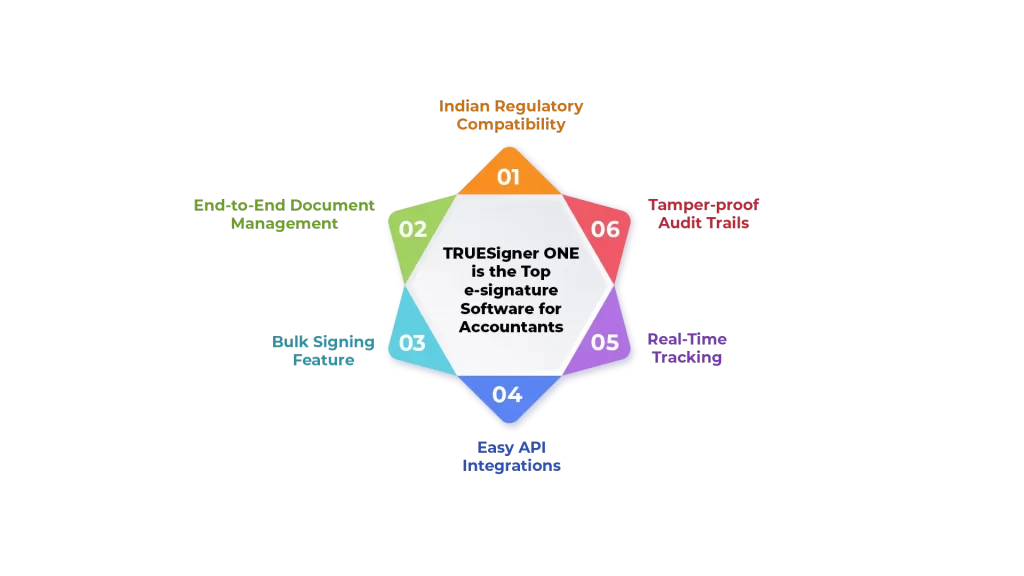

TRUESigner ONE is the Top e-signature Software for Accountants

What sets TRUESigner ONE apart is its India-specific design, catering directly to the needs of accountants, tax consultants, and audit firms. Here’s why it is the leading eSignature software for accountants:

- Indian Regulatory Compatibility: Fully supports Aadhar eSign, PAN-based signatures, and Class 3 Digital Signature Certificates.

- End-to-End Document Management: Upload, sign, track, and archive—all from one dashboard.

- Bulk Signing Feature: Perfect for audit firms managing hundreds of client files.

- Easy API Integrations: Seamlessly integrates with ERP, accounting, and tax tools.

- Real-Time Tracking: Get notified when a document is viewed, signed, or completed.

- Tamper-proof Audit Trails: Ensures traceability and non-repudiation of each transaction.

With over 10,000+ professionals using it nationwide, TRUESigner ONE is not just a product—it’s a trust mark in Electronic Signature Software for Accountants and Taxation.

FAQ

Yes. As per the IT Act, 2000, electronic signatures that use digital certificates issued by licensed certifying authorities are legally valid.

Absolutely. Using electronic signature software, clients can securely review and sign audit reports, balance sheets, and other statements.

Yes. Tools like TRUESigner ONE use robust encryption, access control, and digital audit trails to protect your data.

Almost all engagement letters, Form 16, investment declarations, income tax returns, GST filings, and more.

Through APIs and prebuilt integrations, software like TRUESigner ONE can plug into ERPs, tax platforms, and document management systems.

Summing up

The future of accounting and taxation lies in going paperless, and embracing trusted Electronic Signature Software for Accountants and Taxation is the first step. As remote operations become the norm and compliance requirements get stricter, using a tool like TRUESigner ONE empowers financial professionals to deliver timely, secure, and legally valid services.

If you’re looking for the best electronic signature software for accountants and taxation, TRUESigner ONE is the benchmark in digital compliance and efficiency.