TRUEinvoice

The Direct-to-GSTN implementation for companies with 500 cr+ turnover.

Home / TRUEinvoice

DIRECT

Advantages

If you are a 500 Cr.+ company, GSTN allows you the ability to avail of “Direct eInvoicing”. Truecopy makes it easy for you to call the GSTN direct API from your ERP. If your ERP is on-premise, your eInvoicing Server should be on-premise too!

- No routing sensitive data via any third party.

- Minimal number of hops and minimal latency.

- Directly cross check / verify your eInvoices on GSTN portal.

- Detailed audit trails and records on-premise

HOW

It Works

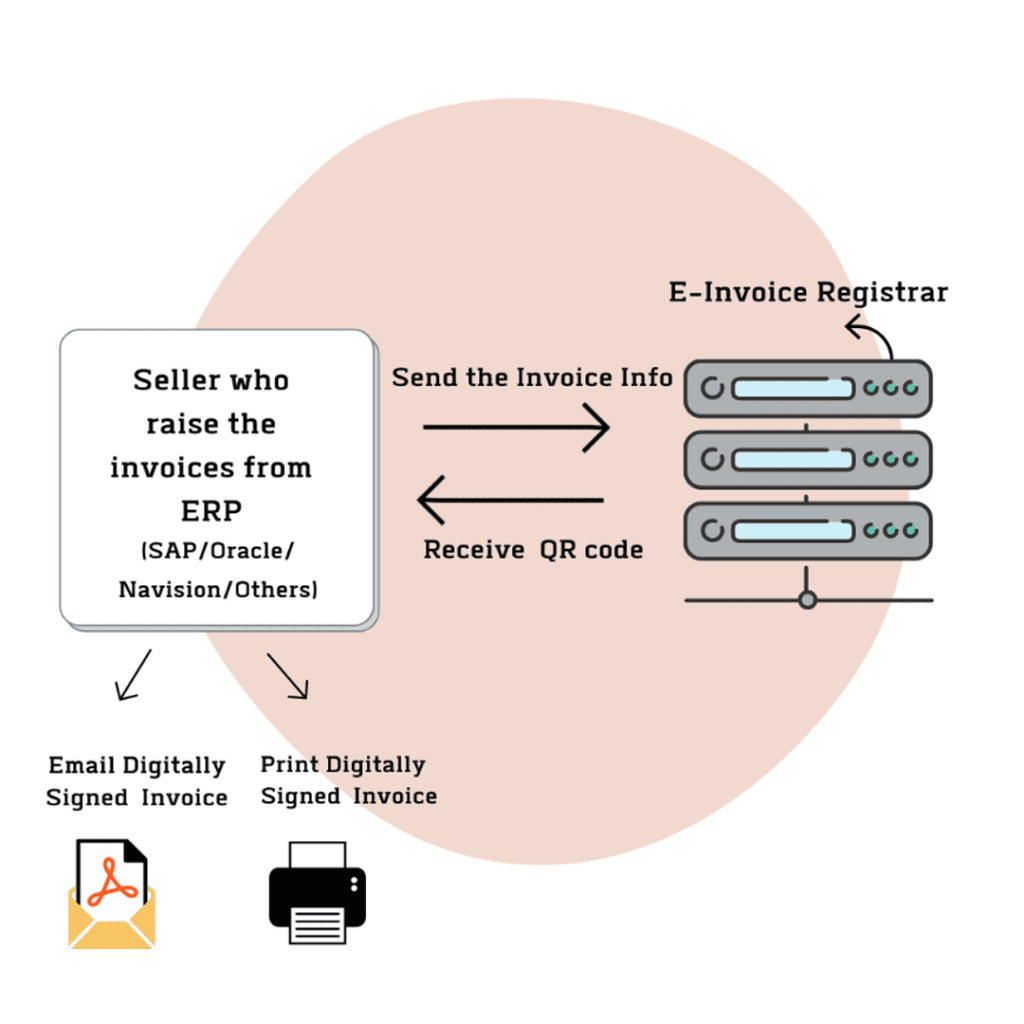

- TRUEinvoice Server co-locates with your ERP and handles all communication with NIC / GSTN, performs validations, retains audit trails.

- TRUEinvoice Server interfaces with existing ERP system to seamlessly enable e-invoicing. We provide you the integration “glue” – function modules that you incorporate into your ERP.

- Invoices can be registered with GSTN by simply calling these functions.

- GSTN returns a QR code and a unique number (IRN) which are auto-inserted on your invoice.

- Invoices can be digitally signed and then Print / Email to the recipient.

Benefits

- On-premise e-invoicing server ensures Security & Privacy of your data.

- Minimal modifications to your ERP, and no changes to your workflows.

- Fast and easy integration & deployment.

- E-invoice will be generated as per the requirement of GSTN – verification directly on GSTN portal.

- Meta Data / JSON archived on the on-premise TRUEinvoicing server.

SAMPLE

Use Case

EInvoicing is mandatory for companies with a turnover greater than 500 Cr. If you are such a company, have an on-premise ERP, and want to ensure the security and confidentiality of your sensitive invoicing data while meeting GESTN obligations, TRUEinvoice is the solution for you.

KINDLY FILL UP THE DETAILS BELOW TO KNOW MORE ABOUT OUR SOLUTION.